U.S. Dollar Losing Value as National Debt Explodes

A sliding U.S. dollar has seized the attention of international currency markets, with many traders left wondering whether it’s a temporary aberration or part of a broader trend.

The dollar has now dropped 6% in value against the euro since the start of the year, and a variety of sources, both micro and macro, are applying pressure on the greenback.

Nationally, the dollar is under pressure because the Federal Reserve and the U.S. government are flooding the system with greenbacks to boost the economy in a time of distress. The glut of supply has served to make each dollar relatively less valuable.

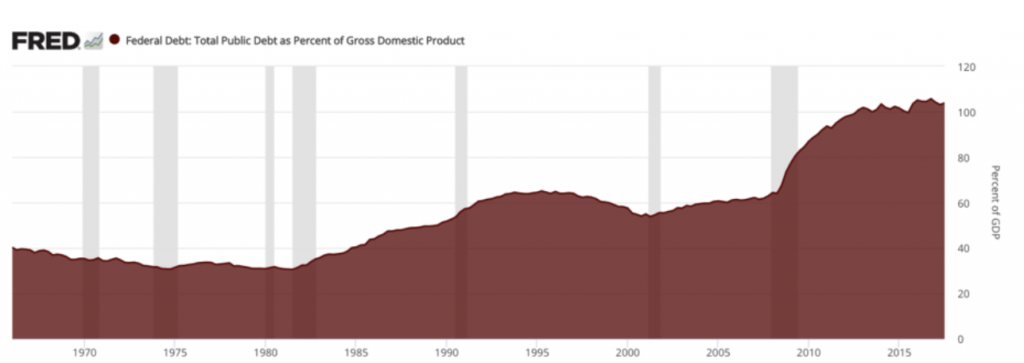

Beyond that, the dollar also appears to be buckling under the pressure of the debt the U.S. government is accumulating.

The national debt has exploded in 2020 and could balloon by $4 trillion to $5 trillion before year’s end—the largest annual increase in history. Compounding the problem is the fact that tax revenues are also down. Taken together, that means the deficit between U.S. government revenues and expenditures is the largest since World War II.

(The August issue of Luckbox magazine took a hard look at Modern Monetary Theory. You should too.)

Federal Reserve officials and memers of Congress suggest that accumulating debt will stimulate the depressed economy, but that doesn’t mean there won’t be repercussions.

A warning shot was fired early this month when the credit rating firm Fitch downgraded the outlook on U.S. debt to negative. For now, the country’s sterling AAA rating has been left untouched.

Maintaining that rating isn’t guaranteed, however, as debt levels across a variety of metrics are surging. Debt as a percent of GDP was less than 65% before the start of the financial crisis in 2008. It has spiked above 107% in 2020.

Note that a reduction in the dollar’s value isn’t necessarily all bad because that trend can make American exports less expensive for overseas buyers. There’s a balance, though, as no country wants its currency to devalue too quickly or by too much.

In the near term, the coronavirus relief package being negotiated by Congress will likely have the biggest impact on the currency’s fortunes.

Republicans are seeking $1 trillion in additional funds to assist businesses and individuals suffering from the economic recession. Democrats, on the other hand, are seeking a more robust financial package totaling nearly $3 trillion.

Politics aside, one can see how the $2 trillion dollar difference hanging in the balance might create considerable uncertainty in the currency markets. Even the difference between the two plans amounts to a nearly unfathomable sum of money.

Beyond the country’s own debt problems, external forces are also pressuring the dollar.

From a macroeconomic perspective, the dollar has long been vaunted as the world’s foremost reserve currency. The dollar benefits from the fact that the American economy is the largest on earth, alongside the reality that the American financial markets are extremely liquid and deep.

That’s not to say there aren’t challengers.

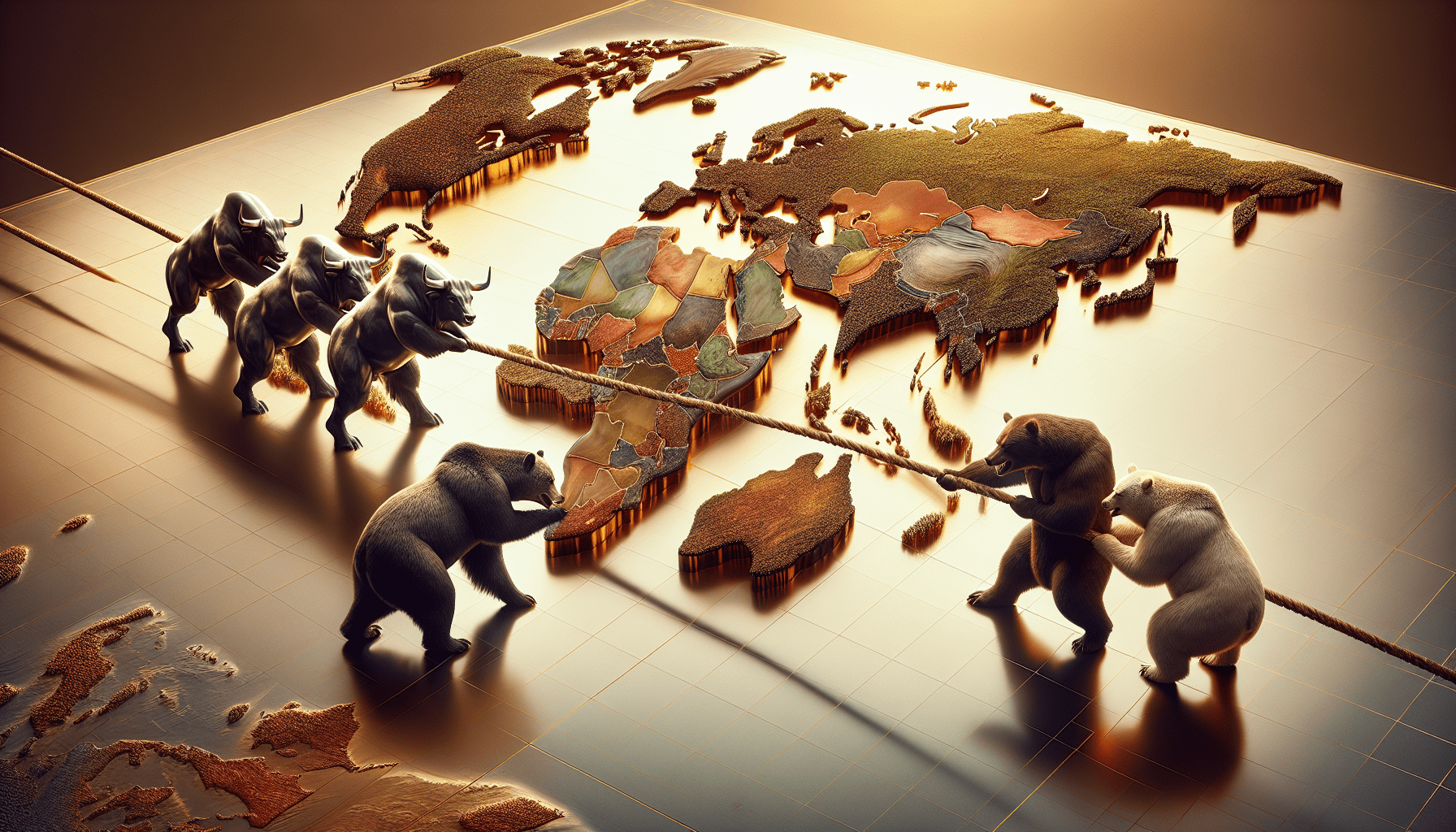

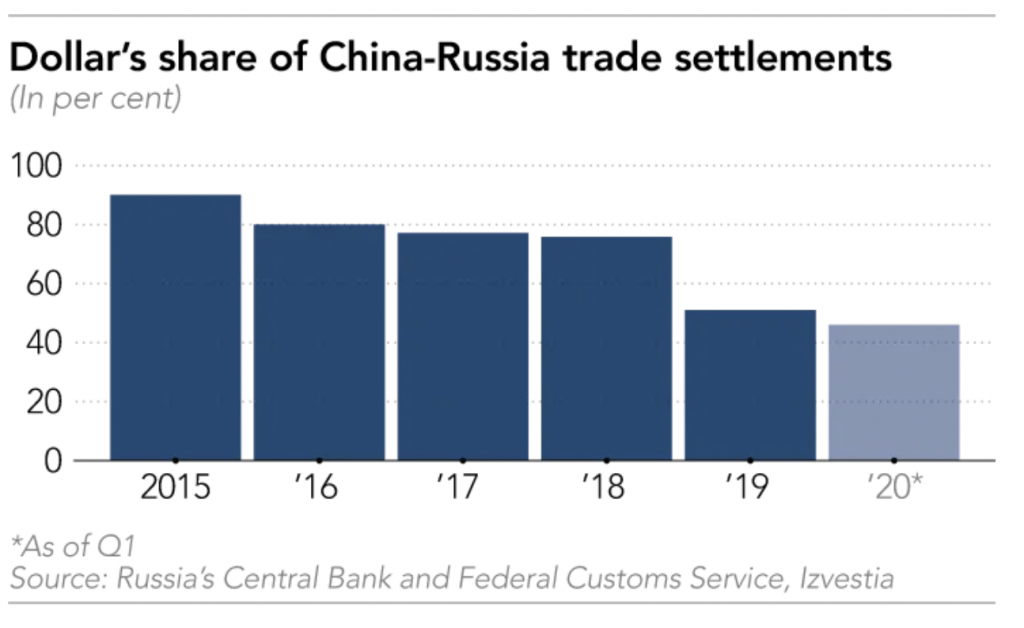

It’s believed that China and Russia have entered a “financial alliance” with the intent of reducing the global influence of the dollar. Actions by the two countries in recent months may weaken the currency at a time when it is particularly vulnerable.

Evidence of Chinese and Russian collaboration was revealed through data released by the Bank of Russia. Meanwhile, China has increased its use euros instead of dollars to pay for Russian goods.

Euros accounted for only 1.3% of Chinese payments for Russian exports during the second quarter of 2018. That number spiked to 51% during the first quarter of 2020. As shown below, that means the dollar’s share in Chinese-Russian transactions has taken a big hit.

Payments by the European Union for Russian exports have reflected a similar trend—increasing from 38% euros in 2018, to 43% euros in 2019.

This is significant because the euro represents the world’s second-largest reserve currency, with 20% of global reserves held in euros, versus 60% for the dollar. By boosting the euro in favor of the dollar, China and Russia are colluding to reduce the dollar’s influence in the global economy.

The reasoning may be that any transaction involving U.S. dollars must ultimately be cleared by an American bank. That provides the U.S. government the ability to freeze those transactions, which arms the country with a boatload of implied financial power.

Diminishing American control over global transactions would undermine the country’s geopolitical influence. This effort is generally referred to as “de-dollarisation.”

While Russia has been trying to undermine the financial power of the United States for some time, it appears China joined the effort more recently—arguably because of the intensifying trade war. China likely recognized that the same type of financial sanctions the U.S. used against Russia in recent years could theoretically be applied to the Middle Kingdom.

Fortunately, the openness of the U.S. economy, relative to those in China and Russia, should prove valuable in helping the dollar maintain its status as the preeminent reserve currency.

Still, action against the dollar can’t be ignored and may provide attractive opportunities for savvy investors and traders.

For other trends in the foreign currency markets and how to trade them, readers may want to review a recent episode of Futures Measures on the tastytrade financial network.

“Sage Anderson” is a pseudonym for a contributor who has traded equity derivatives and managed volatility-based portfolios as a prop trading firm employee. He is not an employee of Luckbox, tastytrade or any affiliated company. Readers may direct questions about this blog post, or any other trading-related subject, to support@luckboxmagazine.com.